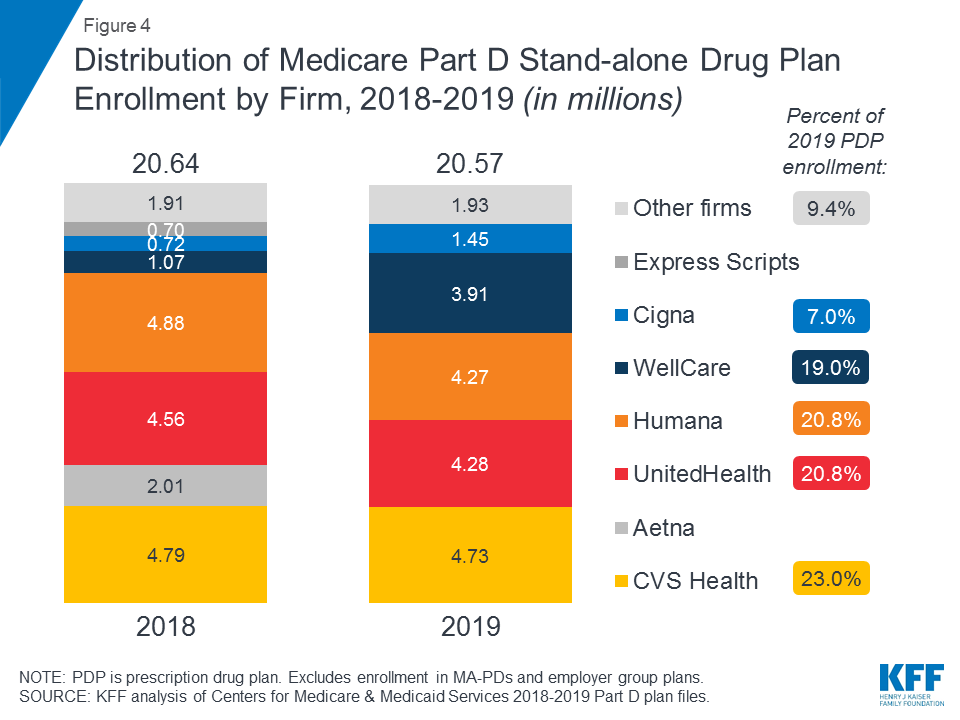

PPO, NPOS, and HMO PLANS – For in-network healthcare services, there is no deductible. In-network preventive services, such as annual exams, are covered at 100%. For other covered services, members pay only a copay when in-network providers are used. All copays, including prescription drugs, count toward the maximum out-of-pocket. HumanaOne Dental Value Plan (DHMO) has a small one-time enrollment fee, no deductible, and no maximum. The plan requires that you choose a dentist from the network. There is a modest co-pay for. The leaders of major health insurers, including UnitedHealth Group, Anthem, Cigna, Humana, Aetna and the Blue Cross Blue Shield Association were at the meeting, according to the White House. Is Humana covering out-of-pocket costs for treatment related to confirmed cases of COVID-19? For the 2021 plan year, Humana will cover out-of-pocket costs for COVID-19 treatment for Humana Medicare Advantage members. Eligible members will have no copays, deductibles or coinsurance out-of-pocket costs for covered services for.

Humana No Copay

United Health Care (AARP) announced today they were waiving the cost share on Medicare Advantage plans. The following is the announcement:

Member’s health is our priority. Recently, we shared news that UnitedHealth Group is taking additional action to directly support people affected by the COVID-19 pandemic by providing over $1.5 billion of additional support for our customers. We wanted to share more details with you.

To help member’s get the care they need, we are waiving cost-share (copays, coinsurance and deductibles) for our Medicare Advantage plan members as follows. Members will have a $0 copay for primary care provider (PCP) and specialist physician services, as well as other covered services (listed below) between May 11, 2020 until at least September 30, 2020. By lowering our PCP and specialist copays to $0, along with our telehealth cost-share waiver, we hope to help make it easier for member’s to access care.

Services included

The following services, if covered by a member’s plan, are eligible for a $0 copay under the cost share waiver, but do not include diagnostic tests and certain other services.

- Primary care provider (PCP) office visits

- Specialist physician office visits

- Physician assistant or nurse practitioner office visits

- Medicare-covered chiropractic and acupuncture services

- Podiatry services and routine eye and hearing exams

- Physical therapy, occupational therapy and speech therapy

- Cardiac and pulmonary rehabilitation services

- Outpatient mental health and substance abuse visits

- Opioid treatment services

The $0 copay applies to services from a network provider and out-of-network services covered by the plan.

Member cost share is not waived for the following services, unless they are related to COVID-19 testing or treatments:

Humana Waives Copay For Specialist

- Lab and Diagnostic tests (radiological and non-radiological)

- Part B and Part D drugs

- Durable Medical Equipment, Prosthetics, Orthotics and Supplies

- Renal Dialysis

- Other services not covered by your plan

Copays, Coinsurance and deductibles for services in the following settings are not waived. Members will be responsible for their share of the cost under their benefit:

- Inpatient hospital and Outpatient surgery or observation services

- Skilled Nursing Facilities

- Emergency, Urgent and Ambulance services

Eligible Members

The cost-share waiver applies to all UnitedHealthcare Medicare Advantage members, including members of Special Needs Plans (SNP) and UnitedHealthcare Group Medicare Advantage plans.

This information is posted on our UnitedHealthcare COVID-19 Health and Wellness page for members. Thank you for being a partner in care to our members during this time.

A health insurance plan with no monthly premium almost sounds too good to be true, but in the world of Medicare Advantage, it’s very common.

In case you’re new to Medicare, Medicare Advantage is an alternative option for health coverage. Medicare Advantage, or MA, is offered by private insurance companies, and it’s approved by Medicare.

MA plans cover everything traditional Medicare covers as well as emergency and urgent care. These plans often include extra perks, like dental coverage, wellness programs, and prescription drug coverage.

Some of the tradeoffs of Medicare Advantage when comparing it to Original Medicare are the networks and the co-pays, which accumulate to a maximum out-of-pocket limit anywhere between a couple thousand dollars to as high as $6,000 and even a little higher. Networks are restrictive, so you’ll need to make sure your preferred doctors are in the network before choosing a plan. Deductibles and co-pays also tend to range anywhere from $3,000 to nearly $7,000, which is much higher than Original Medicare.

No Copay For Humana

Before you aged into Medicare, you were probably used to seeing health insurance plans with monthly premiums of over $500, and in some cases, even $800+.

Humana Copay Schedule

So, how is it even possible that Medicare Advantage plans often have little to no monthly premium?